How to Become an Insurance Claims Adjuster

Everything about being an insurance claims adjuster

15 Jan 2025

If you're someone who loves investigative work, has a knack for numbers, and enjoys negotiating, becoming an insurance claims adjuster could be a perfect fit. Whether you're looking for the stability of a 9-to-5 job or the freedom that comes with freelance work, the field of insurance claims offers plenty of opportunities. So, if you're curious about how to become an insurance claims adjuster or how to become an independent insurance adjuster, here's how to get started:

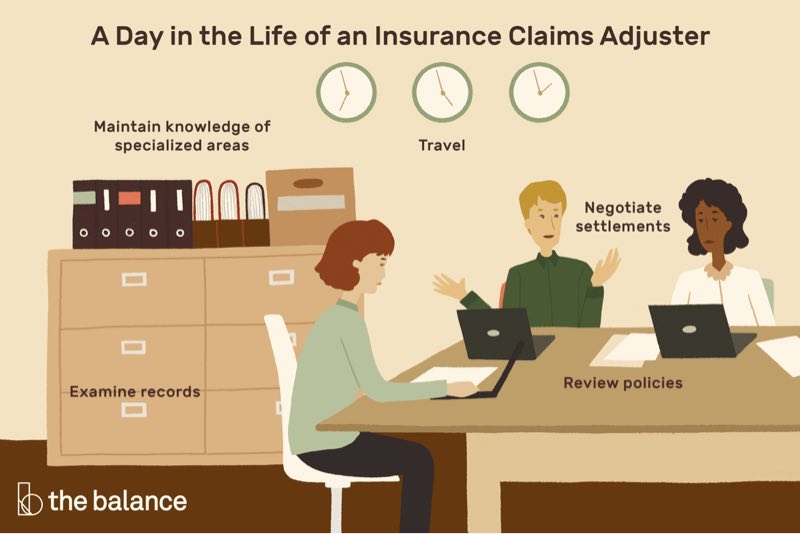

What Does an Insurance Claims Adjuster Do?

An insurance claims adjuster’s job is all about looking into claims made to insurance companies and figuring out whether the company is responsible in each situation. They play a crucial role in making sure claims are legitimate, assessing the damage, and deciding on fair payouts. Adjusters can work in different areas of insurance, like auto, health, life, and property, each with its own unique set of challenges.

Depending on the type of claim, their responsibilities may include:

Interviewing all parties involved, including claimants, witnesses, and experts.

Reviewing police and medical reports.

Gathering supporting documentation like photographs and records.

Assessing the damage or injury and determining the extent of insurance coverage.

Compiling a comprehensive report for the insurance company.

Notifying all parties of the claims decision.

Some adjusters focus on property damage claims, while others deal with personal injury or third-party property damage. They can either work directly for an insurance company or as independent freelancers, taking on cases as needed. It all depends on the kind of work they prefer and how they want to structure their career.

How to Become an Insurance Claims Adjuster

1. Complete the Minimum Education Requirements

Most employers require at least a high school diploma or equivalent to get started as an insurance claims adjuster. However, having a higher degree such as an associate’s or bachelor’s degree can set you apart. Degrees in business, finance, management, or communications are particularly relevant for this profession.

2. Decide on the Type of Adjuster You Want to Be

There are different types of adjusters you can become, including:

Staff Adjusters: These adjusters work directly for an insurance company.

Independent Adjusters: Freelancers who are hired on a case-by-case basis by insurance companies.

Public Adjusters: These professionals represent policyholders, not insurance companies, to help them settle claims.

Each type of adjuster has distinct career paths and requirements, so it’s important to decide early which one suits your preferences.

3. Meet Licensing Requirements and Earn Your License

Many states require claims adjusters to obtain a license, though the process varies by state. Typically, you’ll need to complete a pre-licensing course and pass an exam. The courses are available in both classroom and online formats. It’s essential to research your state’s specific requirements. Some states do not require licensing, including Colorado, Kansas, and Missouri, but for those who want to work across state lines, securing a reciprocal license may be necessary.

4. Enhance Your Credentials with Certifications

While not mandatory, obtaining certifications can increase your marketability and demonstrate your expertise. Two well-known certifications are:

Associate in Claims (AIC)

Chartered Property Casualty Underwriter (CPCU)

These certifications show your commitment to the profession and can help you advance in your career.

Salary and Job Outlook

The salary of an insurance claims adjuster varies depending on the type of position. Independent adjusters often earn more, with the potential for annual earnings exceeding $100,000. Staff adjusters, on the other hand, earn between $45,000 and $80,000 annually.

The demand for insurance claims adjusters is growing. Over 349,000 claims adjusters are employed in the U.S., and it’s projected that more than 25,000 new positions will open each year from 2020 to 2030. This growth ensures plenty of job opportunities, especially for those with multiple state licenses.

READ MORE: How to Become a Remote Insurance Agent in 2024?

How Long Does It Take to Become a Claims Adjuster?

The time it takes to become an insurance claims adjuster depends on your prior experience and education:

No Work Experience or High School Diploma: It may take 2-4 years to meet all requirements.

With Relevant Work Experience and a High School Diploma: You can earn your license and begin working in as little as a few weeks.

Key Skills Required for an Insurance Claims Adjuster

To succeed in this role, you will need a combination of technical knowledge and interpersonal skills:

Customer Service Skills: Patience, empathy, and clear communication are critical, especially when dealing with clients who may be facing difficult circumstances, such as the aftermath of a natural disaster.

Analytical Skills: You will need to assess damages, understand policy details, and make sound decisions based on the information gathered.

Driving Skills: Many claims adjusters are required to inspect properties or vehicles in person, so being able to drive is essential.

Technology Skills: Familiarity with claims management software like Xactimate is helpful. This software helps streamline the claims process, and each insurance provider may have its own operating systems that you’ll need to learn.

Becoming an insurance claims adjuster offers a dynamic and rewarding career, whether you’re seeking stability in a traditional role or the flexibility of freelance work. With a combination of investigative work, analytical thinking, and strong communication skills, you’ll be at the heart of helping individuals navigate difficult situations while ensuring fair resolutions. It is a great choice for those who are up for the challenge.

For more opportunities, check out the insurance jobs available at Hirey.

Chat with Rey now! ➤ Click Here